The EU has banned the import of Belarusian furniture. The decision, published at the end of June, specifically prohibits the import of furniture falling under customs codes 9401 and 9403.

The move shuts down the bloc’s purchases of Belarusian wood furniture, worth more than 112 million Euros between April 2023 and April 2024, and over a quarter of a billion Euros since the start of the invasion. Germany and Poland have been the main entry points for these products in recent months, followed by Lithuania and Romania.

For contracts concluded before 1 July 2024, the ban will not be applicable until 2 October 2024.

Also reported here: EU finally bans torture-stained Belarusian furniture trade | Earthsight

This article summarizes the science behind World Forest ID, but also gives a glimpse at the support provided by Australia, work now being done by IKEA (which used to source extensively from Russia and Belarus), and a recent Belgian investigation into illegally sourced wood imports.

Also reported here: Keeping Sanctioned Russian Timber Out of the EU Is Tricky. This Nonprofit Has a Solution. – WSJ

Russia and Belarus now account for 70% of all Chinese lumber imports.

Russia is ramping up plywood production, with exports to China surging more than 344%, according to new data provided by Roslesinforg – the Russian state-owned customs agency.

The latest numbers come after China Customs reported that exports to China had tripled for March. environmental groups have flagged concerns that China is operating as a broker for Russian and Belarussian timber, with plywood made from Russian birch entering European markets via China, Vietnam and a series of “friendly countries” across Eurasia.

Until early 2022, Australian timber importers relied on Russia for 40% to 50% of all LVL, formwork and beams entering the Australian building and construction supply chains.

However, that changed in mid-2022 when the European Union banned Russian and Belarusian timber exports, whilst PEFC and FSC suspended certification schemes in both countries. And whilst Australia opted to slap a 35% tariff on Russian timber rather than following the lead of the EU and the UK in introducing a total ban, FSC and PEFC deemed that all products coming from Russia and Belarus (irrespective of secondary ports) are conflict timber, and therefore, cannot be used in PEFC and FSC claims.

According to the Australia’s EWPAA, “signs of non-conforming LVL include missing branding details, questionable certification, and a lack of acceptable documentation.”

Signatories of an open letter have called for an independent investigation into furniture produced in Belarusian jails and exported to the EU. They claim the Forest Stewardship Council shut its eyes to forced labor.

Russia is now facing a growing gap between timber production and log supply, with production growing 5% in 2024, while commercial logging of Russian forests has nose-dived 26%.

That is according to Lesprom’s “Russian Lumber Industry Insights,” which reports that Russian sawmills are now bleeding thanks to a critical shortage in raw materials and are struggling to meet rising demand from major export markets.

The problem for Russia is that Western Companies—which provided much of the foreign direct investment needed to modernise logging operations in the decades leading up to the 2022 war—have now exited the country on mass, creating large gaps in the Russian supply chain.

Poland is the new gateway for Belarussian timber, with the import of timbers (via Kazakhstan) surging. A joint investigation involving the Belarussian Investigative Center, Radio Free Europe, and Polish newspaper Gazeta Wyborcza alleges that Polish imports of timber from the largely deforested Kazakhastan grew from €14 million (pre-war) to more than €68 million last year as part of a €126 million global trade in conflict timber.

Also featured in Belarus evading EU sanctions by importing timber to Poland with false documents, finds investigation | Notes From Poland and Fraud Exposed: Poland Now EU’s Ground Zero for Conflict Timber | Wood Central

Scientists are using state-of-the-art tech to correctly trace the flow of timbers entering the EU from Russia and Belarus and have developed a new framework that policymakers can use to eliminate conflict timber worldwide.

Developing the world’s largest reference database for Eastern European timber species (Betula, Fagus, Pinus, Quercus) tailored to sanctioned products; scientists can correctly predict, with 82% accuracy, “false claims” coming from Russia as well as harvest locations “within 180 to 230 km of the actual location.”

When Russia invaded Ukraine in February 2022, sanctions swiftly followed, including a total ban on Russian timber imports into the European Union (EU) from July 2022. Belgium, one of the staunched supports of the EU ban, has become a profitable destination for Russian wood. Using a forensic laboratory at the Royal Museum for Central Africa in Tervuren, inspectors determined that several wood shipments from Russia had arrived in Belgium. The number of fines imposed for illegal harvests almost tripled in 2023.

“But an impediment is a distinct lack of inspectors,” Wynant said. “There are now fewer than five timber inspectors working full-time in Belgium, but there are 4500 timber importers,”according to the article .

The letter demands an independent investigation by the Forest Stewardship Council (FSC) into its past certification of forests and a timber trade connected to torture, repression, and destruction of nature in Belarus.

Timber trade from Belarus has increased six times since the start of the Ukraine conflict amid fears that Azerbaijan is being used to bypass sanctions. Since early 2022, western sanctions on Russian and Belarussian trade have limited the export of pulp, paper and softwood to nine countries – China, Kazakhstan, Belarus, Uzbekistan, Iran, Kyrgyzstan and the United Arab Emirates and Azerbaijan

Russia and Belarus are ramping up timber exports to Uzbekistan amid fears the former soviet state could act as a new trading post for conflict timber entering global timber supply chains.

It comes as Uzbekistan is spending billions on new rail, road and sea infrastructure, funded by China’s Belt and Road Initiative, forging new pathways for timber to infiltrate global supply chains.

Already, Uzbekistan is Russia’s second-largest importer of softwoods, with 480,000 cubic metres of timber (or 11% of its total imports) imported into the country every quarter – in what is a significant escalation in trade since the start of the Russian invasion of Ukraine.

It comes as Wood Central reported in July that a block of ten countries – including Uzbekistan as well as China, Kazakhstan, Belarus, Iran, Kyrgyzstan, the United Arab Emirates, Azerbaijan, and Tajikistan – is fueling a booming trade of conflict timber bypassing western sanctions.

The EU first imposed trade sanctions on Belarus timber products on 2 March 2022. These were extended to Russian timber products on 8 April 2022. On 10 March 2022, Russia’s Industry and Trade Ministry announced a ban on all wood and timber-related exports to “unfriendly countries”, including the EU, UK and US. Both leading certification organisations, the PEFC and FSC, announced in March 2022 that all timber originating from Russia and Belarus would be categorised as ‘conflict timber’ (i.e. from a controversial source) and not eligible to be sold and promoted as PEFC- or FSC-certified. This had a significant impact on many European companies which had become heavily dependent on Russia and Belarus for their supplies of certified wood.

The EU first imposed trade sanctions on Belarus timber products on 2 March 2022. These were extended to Russian timber products on 8 April 2022. On 10 March 2022, Russia’s Industry and Trade Ministry announced a ban on all wood and timber-related exports to “unfriendly countries”, including the EU, UK and US. Both leading certification organisations, the PEFC and FSC, announced in March 2022 that all timber originating from Russia and Belarus would be categorised as ‘conflict timber’ (i.e. from a controversial source) and not eligible to be sold and promoted as PEFC- or FSC-certified. This had a significant impact on many European companies which had become heavily dependent on Russia and Belarus for their supplies of certified wood.

EU27 import value of wood and wood furniture from China increased only 4% to US$6.0 billion in 2022, although this did build on a massive 42% gain the previous year. Import value from Ukraine also increased by 9% to US$1.9 billion in 2022, despite the serious disruption due to the war, following a 55% gain the previous year. Other significant beneficiaries were Turkey, for which EU27 import value increased 32% to US$890 million last year, and non-tropical products from Brazil which recorded a 54% increase to US$ 690 million in 2022

On the anniversary of Russia’s invasion of Ukraine last week, G7 countries announced new sanctions on Russia and Belarus.

This new Earthsight article shows that since the conflict began, the USA, Canada, Japan, the EU and the UK have imported timber and wood products worth over $2.9 billion from Russia and Belarus.

Though the EU and UK have sanctions in place on most wood products, they omit some key products. Meanwhile Japan, the US and Canada have not put into place any ban on wood products from Russia and Belarus.

Earthsight’s latest report revealed that over $1.2 billion of Russian plywood has been sold in the US since the conflict began, with profits funneling directly to Putin’s allies, and possibly helping to fund Russia’s military.

*******************

The article is a useful summary of the existing sanctions put into place on Russian and Belarus timber products.

Not long after imposing sanctions on wood imports from Russia and Belarus, Europe saw an influx of wood supposedly coming from Kazakhstan and Kyrgyzstan. Authorities say sanctions-busters are increasingly mislabeling wood as Central Asian so they can keep bringing it in to the EU.

Key findings:

Traders are evading European Union sanctions on Russian and Belarussian wood by declaring that it really comes from Central Asia.

Customs in Lithuania and Latvia are scrambling to keep up with the sudden influx of timber with suspect paperwork from Kazakhstan or Kyrgyzstan.

Reporters found several Kyrgyz and Belarusian companies that offered false paperwork so traders could ship banned Belarusian wood to the EU.

Timber chiefs have warned that imports of the material from Russia or Belarus could now be deemed illegal in the UK. The Timber Trade Federation (TTF) told its members that purchases from suppliers in the ostracised nations could fall foul of regulations initially coming into force nine years ago in part to tackle illegal logging abroad.

FSC and PEFC have barred wood and timber from Russia and Belarus from their certified products, as a host of other industry suppliers go public with their stance against Russia’s war in Ukraine.

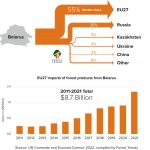

EU imports of forest products from Belarus increased by 432% over the last decade (2011), yielding US$8.7 billion in revenue. As imports grew, so did the EU’s market share. 55% all reported forest product imports from Belarus went to the EU. As such, sanctions have the potential to cut off over half of Belarus’s timber revenues. The aim of sanctions is to put pressure on governments and individuals, thus using financial leverage to promote rule of law, democracy, and a respect for human rights. The EU’s sanctions against Belarus could be effective, if robustly implemented.

Sanctions breakdown as Belarussian timber exports surge 8-fold for the first three months of 2024.

Timber exports from the heavily sanctioned Putin-aligned state have exploded over the past 12 months, with more than 365,000 cubic metres of sawn wood traded into 15 “friendly nations” in the first three months of 2024 alone.

That is according to the government-backed Belarusian Universal Commodity Exchange (BUCE), which reported that Belarus timber production was up eight times over the January to March quarter for 2023, with the total output of Belarussian timber reaching 748,000 cubic metres— including 49% traded into global markets via third-party Eurasian trading ports.

Click here to access the Global Illegal Logging and Associated Trade (ILAT) Risk assessment tool and to download the Forest Trends User Guide describing the functionality of the ILAT Risk Data Tool.

Click here to access the Cattle Data Tool.