The European Green New Deal is an opportunity for US timber producers.

The European Union’s Green New Deal and other environmental regulations are creating opportunities for North American timber producers. Europe needs to reduce its local timber production by approximately 132 million cubic meters over the next decade to meet The EU Green Deal. This reduction will force Europe to seek alternative timber sources, with North America positioned to capture the largest share (38 percent) of this displaced demand, followed by South America (25 percent) and Asia (19 percent).[1]

The EU’s timber supply gap should naturally favor US producers, as North American timber operations typically maintain high standards of forest governance and environmental compliance. In contrast, timber from regions like Asia, Africa, South America, and often re-exported from China often carries higher risks of illegal harvesting, poor forest governance, corruption, and in some cases, links to transnational organized crime — all of which would send up red flags for violations of the EU Timber Regulation (EUTR) and forthcoming EU Deforestation Regulation.

Russian timber threatens to undermine US producers.

However, a flood of illegal Russian timber entering European markets is undermining this trade opening — despite apparent violations of both European sanctions and the EUTR. Several timber species naturally occur in both North America and Russia (such as oak, birch, and pine), making it easy for traders to mislabel Russian timber as North American-sourced material. Russian birch is frequently documented as American white birch or paper birch to circumvent regulations like the US Lacey Act and EUTR, which specifically prohibit the trade in illegally sourced timber products. This illegal Russian timber trade operates through sophisticated laundering operations and circumvention is hard to detected as they re-export from countries such as China, Turkey, Kazakhstan, and Georgia.

Despite sanctions against Russian products, more than €1.5 billion worth of Russian timber has been smuggled into the European Union since June 2022.[2] This illegal trade involves all 27 EU member states and represents approximately 500,000 cubic meters (m3) of timber products, including furniture, flooring, toys, and construction materials. Even major American corporations are unwittingly involved, with illegal Russian wood products finding their way into flooring used by prominent hotel chains including Radisson, Hilton, and Marriott. Earthsight estimates that more than 700 m3 of plywood alone enters European ports daily through third-party countries.[3]

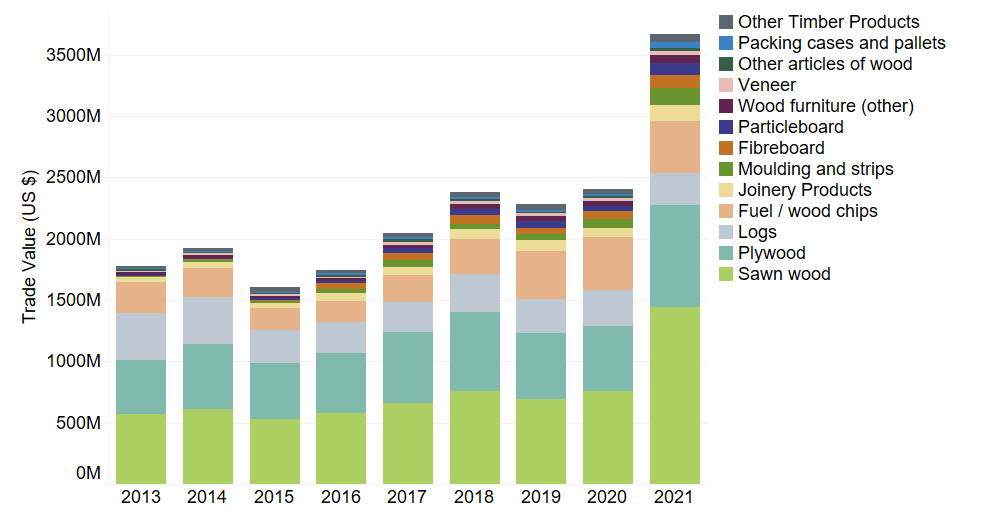

Russian exports of timber products to EU27+European Free Trade Association (EFTA) by trade value

Illegal logging in Russia is widespread.

The scale of illegal logging in Russia is staggering, with estimates suggesting 15-50 percent of all timber harvested in Russia may be illegal. [4] Illegal logging in Russia devastates vast tracts of pristine boreal forest, particularly targeting valuable species like Korean pine and Mongolian oak, which can take centuries to reach maturity. This uncontrolled harvesting fragments critical wildlife habitats home to endangered species like the Amur tiger and Far Eastern leopard, and it removes millions of cubic meters of wood from protected areas. Beyond environmental damage, illegal logging also displaces indigenous communities who rely on forest resources for their traditional ways of life, destroying sacred sites and undermining their cultural heritage and economic survival.

The ripple effects extend globally as this illegal timber enters international markets through elaborate laundering schemes, fueling corruption, enabling organized crime networks, and creating unfair competition that undermines legal and sustainable forestry operations worldwide. This undercuts US producers’ pricing and ability to expand their market access.

Illegal Russian timber can cause market distortion and negative economic impacts for US producers of verified legal and sustainable wood products.

Key consequences include:

- Price suppression: Illegal Russian timber enters markets at artificially low prices, undercutting legitimate US producers who operate under strict regulatory compliance.

- Reduced market share: Despite favorable EU policies, US producers that can demonstrate their products as legal and sustainable struggle to capture their expected share of the European market.

- Unfair playing field: Legal and sustainable US operators cannot compete with the illegal operators that are cutting corners and avoiding compliance with their own national laws and regulations.

- Investment uncertainty: The unfavorable market conditions created by illegal competition discourage investment in US timber operations.

Key recommendations based on these findings:

Immediate Actions

- Encourage Europe, China, and other manufacturing hubs to enhance Supply Chain Verification by implementing stronger mechanisms to verify timber origin, particularly for species common to both North America and Russia.

- Increase market education by supporting European buyers’ understanding of the risks of accepting timber from third-party countries known to be laundering Russian material.

- Bolster regulatory coordination between US and EU enforcement agencies to better track and prevent timber laundering.

Long-term Solutions

- Improve species-specific tracking by improving systems to authenticate the origin of commonly laundered species like birch, pine, and oak.

- Invest in tracking technologies to create verifiable chains of custody.

- Create preferential market access mechanisms for verified legal timber sources.

[1] Europe’s Costly Fix: Tackling it’s 132M Cubic Metre Timber Shortfall | Wood Central

[2] https://www.earthsight.org.uk/news/blood-stained-birch-press

[3] https://www.earthsight.org.uk/blood-stained-birch

[4] https://crsreports.congress.gov/product/pdf/IF/IF11114

Viewpoints showcases expert analysis and commentary from the Forest Trends team.

Connect with us on Facebook and Twitter to follow our latest work.