Momentum for net zero greenhouse gas emissions by 2050 is building among investors and corporates. What’s yet to be harnessed, though, is the potential for retail investors to drive a powerful trend for net zero portfolios from today.

BlackRock and Vanguard have recently joined the Net Zero Asset Managers initiative, a group of 43 investments firms managing more than $22.8 trillion of assets.[1] In the real economy, corporate voluntary commitments have tripled since 2019, with more than 1500 companies targeting net zero by 2050 or sooner.[2]

Corporate demand for carbon offsets is rising rapidly. While reaching net zero will ultimately mean companies fully mitigate their own emissions without relying on offsets, many sectors needs access to large-scale, affordable, and near-term mitigation options that provide a more flexible pathway for technology investment and de-carbonization.[3]

In the financial sector we are witnessing a rapid evolution in climate metrics, driven by both regulatory pressure and consumer-driven trends toward sustainable investment, helping investors prioritize low carbon strategies. However, only now are platforms emerging that mobilize demand for carbon offsets from investors. Recently Cushon, a UK based investment firm for employers and savers, has started to offer “the world’s first net zero pension” committed to achieving net zero from today, rather than by 2050, through the use of offsets.

And, with or without support from investment managers, emerging financial technology platforms available on android and web interfaces (such as Sugi.earth which uses S&P Dow Jones Trucost metrics) will provide retail investors with carbon footprint data, allowing them to prioritize lower carbon or climate transition strategies, and additionally to use offsets to immunize against residual carbon intensity in savings vehicles, allowing them to become net zero investors very much earlier than 2050.

Investor demand for carbon offsets, as a supplement to lower carbon portfolios, should take off in the coming years and, if focused on those credits with the highest environmental integrity, would reinforce corporate action and provide a huge boost to international climate finance programs in developing countries––including the long-wished for, massive scale carbon revenue signal that would make the economics for tropical forest countries of ending deforestation overwhelmingly compelling–– a sine qua non for achieving the goals of the Paris Agreement.

The rationale for retail investors to use carbon offsets

Investor interest in low carbon strategies has evolved due to regulatory pressure and consumer-driven trends toward Socially Responsible Investment. The Financial Stability Board’s Task Force on Climate-Related Financial Disclosures and the UK Pensions Scheme Bill of November 2020 provide examples of regulatory pressure for investment managers and pension fund trustees to climate stress-test portfolios. And ESG assets are set to hit $53 trillion by 2025, a third of global Assets Under Management.[4] Against this backdrop climate risk metrics have been gaining traction. MSCI and S&P Dow Jones have created Low Carbon, Paris Aligned and Climate Transition indexes.

However, constrained by fiduciary responsibility to maximize financial returns, neither standard nor SRI nor low carbon funds have any “willingness-to-pay” for public goods. There is growing evidence of consumer appetite to offset the carbon impact of a range of activities from flights to car fuel and credit card purchases. Retail investors can also express their willingness-to-pay for climate change mitigation with carbon credits and thus accept below-commercial returns in order to have a climate impact that goes beyond business-as-usual.

Low carbon strategies are an effective way to reduce carbon footprints but are skewed to concentration risk in a small number of sectors. And, while continued climate policy tightening should create a positive secular trend for low carbon investments, these strategies could become expensive (either because policy is insufficiently ambitious or because flow of funds into low carbon products drives valuations too high). The Financial Times recently pointed out that fossil fuel equities prices, broadly, have been rising this year, with many clean energy equities performing weakly, or declining.[5] Both investment managers and retail investors need the flexibility to switch out of green equities if they perceive them to be overvalued––indeed investment managers would have a fiduciary responsibility to do so. In such a scenario, investors can hold standard portfolios and pay for offsets to maintain the same carbon footprint. And recognizing that none of the mainstream index-based low carbon strategies are currently decarbonizing sufficiently to be truly aligned with Paris Agreement goals, some investors will be willing to pay extra to achieve net zero.

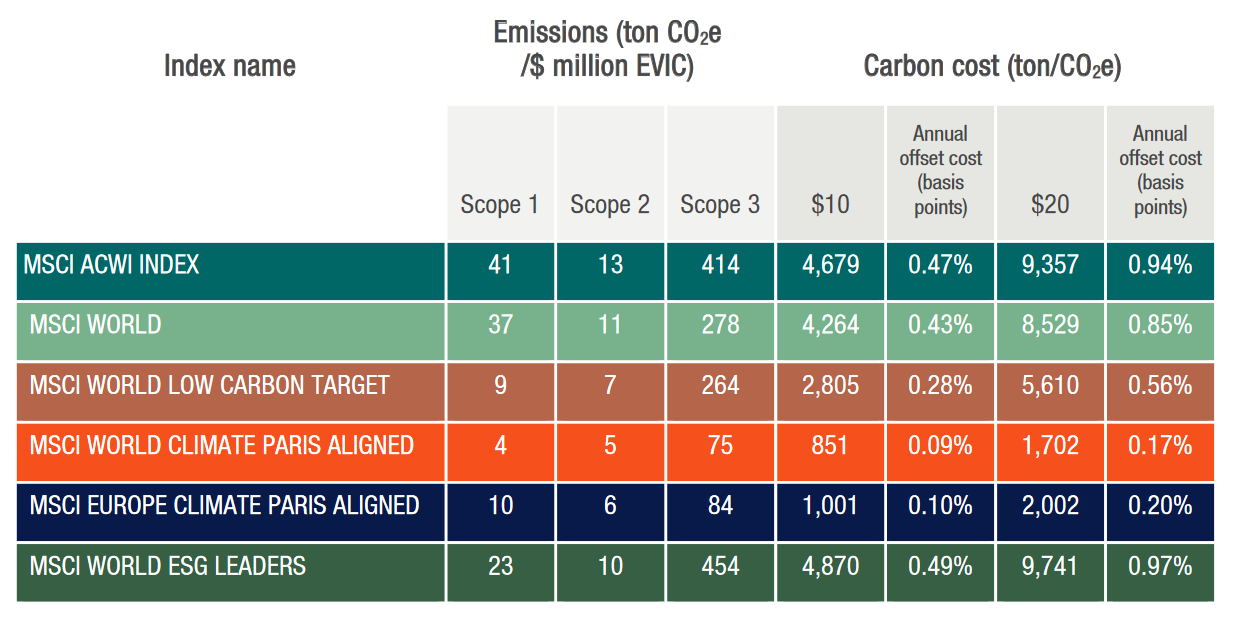

Analysis of MSCI data last year illustrated the relative costs of offsetting to achieve net zero across different indexes, based on carbon credit prices of $10 and $20 per ton of carbon dioxide equivalent (CO2e).[6]

Thus, based on what would currently be a high carbon credit price of $20 per ton of CO2e, the flagship MSCI ACWI Index would cost 0.94% per annum to offset, the World Low Carbon Target 0.56% and the World Climate Paris Aligned just 0.17%.

Harnessing carbon offset demand to end tropical deforestation

It will be impossible to achieve the goals of the Paris Agreement without “Nature-based Solutions” to climate change (in particular forest protection and restoration), which offer around 30% of the greenhouse gas mitigation needed.[8]

Growth in demand for offsets could enable donor governments and multilateral institutions to leverage massively more private co-funding for climate aid in developing countries. This trend would be given a huge boost from investors seeking to achieve net zero using offsets––both increasing absolute levels of funding and reinforcing competitive pressure for corporate action.

Initiated by Mark Carney, the UN Special Envoy for Climate Change, the Institute of International Finance Taskforce on Scaling the Voluntary Carbon Market was set up in 2020 to build a much larger-scale credit trading market. Fitch Ratings has been among those highlighting concerns about a supply crunch for offset projects.[9] And it will take time to resolve the question marks over environmental integrity, differing accounting standards and long project lead times which have led to low prices; as well as the relationship between the voluntary market and the yet to be negotiated rules for market-based approaches under Article 6 of the Paris Agreement.

Happily, there is one class of carbon credits with the capacity to supply multiple gigatons of demand in the next 10-15 years. REDD+ (the framework launched under UNFCCC for supporting reduced emissions and increased carbon removals from tropical forests), uniquely among climate change mitigation approaches, benefits from an already negotiated article in the Paris Agreement. Under Article 5, developed countries make results-based payments to forest country governments for meeting emission reduction outcomes measured at the “jurisdictional” (national or regional) level. To date Norway, Germany and the UK, the World Bank and the UN Green Climate Fund have committed about $10 billion under this mechanism. Governments, now joined by the new US administration, are committing more (including through the use of floor prices) and looking to partner with private funding at a truly transformational scale through initiatives such as the LEAF Coalition[10] and Green Gigaton Challenge.[11]

Carbon credits generated at a national scale have vastly greater supply potential than those at the project level (although good projects will contribute to national outcomes). For jurisdictional REDD+ the challenge is not demand for carbon outstripping supply but rather the absence to date of sufficiently large-scale and well-priced demand signals to transform the economics of conservation for forest countries.

Failure to end tropical deforestation would force governments to impose ever-tighter and more urgent rates of decarbonization on businesses, and an ever-larger burden on yet to be developed negative emissions technologies. Or a surge in mitigation costs could reduce political ambition at a moment when emission reduction policies need to be tightened, thus increasing vulnerability to physical impacts of climate change, with disastrous effects on financial stability.[12]

Retail investors can drive a trend for net zero portfolios from today rather than 2050. At the end of 2020, the MSCI ACWI index had a total market capitalization of $49 trillion,[13] representing 23 billion tons of annual CO2 emissions. Even if only a small percentage of investors supplement low carbon and climate transition strategies by using high integrity carbon offsets, collectively they could provide a huge boost to government efforts to secure private funding to unlock the vast mitigation potential of Nature-based Solutions, critical to minimizing the global economy’s costs of transition to climate stability.

[1] Vanguard, BlackRock Join Investors Pledging to Hit Net Zero, By Alastair Marsh and Jess Shankleman. 29 March 2021, 05:01 BST Updated on 29 March 2021, 17:35 BST

[2] Data-Driven EnviroLab & NewClimate Institute. (2020). Accelerating Net Zero: Exploring Cities, Regions, and Companies’ Pledges to Decarbonise. Research report prepared by the team of: Angel Hsu, Zhi Yi Yeo, Amy Weinfurter, Yin Xi Tan, Ian French, Vasu Namdeo, Odele Tan, Sowmya Raghavan, Elwin Lim, and Ajay Nair (Data-Driven EnviroLab) and Thomas Day, Silke Mooldijk, Niklas Höhne, and Takeshi Kuramochi (NewClimate Institute). https://newclimate.org/2020/09/21/accelerating-net-zero-exploring-cities-regions-and-companies-pledges-to-decarbonise/

[3] Koch, N., Reuter W.H., Fuss, S., and Grosjean, G. 2017. Permits vs. offsets under investment uncertainty. Resource and Energy Economics 49, 33-47. doi: 10.1016/j.reseneeco.2017.03.006.

[4] https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

[5] “Fossil fuel investors leave clean peers green with envy”. The Top Line. John Dizard. FT 3rd April 2021.

[6] https://www.forest-trends.org/publications/the-net-zero-transition-and-offsetting-of-carbon-intensity-in-retail-investment-portfolios/

[7] Certain data provided by MSCI Inc. ©2021 in accordance with msci.com/disclaimer. All rights reserved.

[8] Griscom, B.W., et al. 2020. National mitigation potential from natural climate solutions in the tropics. Philosophical Transactions of the Royal Society B 375. doi: 10.1098/rstb.2019.0126

[9] Special Report: Tightening Climate Policy to Drive Carbon Offsetting and Emissions Trading. Fitch Ratings. September 2020

[10] https://www.leafcoalition.org

[11] https://www.greengigaton.com

[12] Fuss, S., Golub, A., Lubowski, R. 2020. The economic value of tropical forests for meeting global climate stabilization goals. Submitted to Global Sustainability.

[13] https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb

Viewpoints showcases expert analysis and commentary from the Forest Trends team.

Connect with us on Facebook and Twitter to follow our latest work.