A strengthened Ruble, weak import duties and a decline in European demand is a perfect storm – with the peak body for furniture now urging Putin to ramp up import duties to protect the local industry.

Italy and Germany are the leading contributors to the surge entering Russian ports, with export volumes from both countries nearing pre-COVID (and Ukraine war) levels. At the same time, Russian domestic production has dropped by 2%, with the cost of materials and other components—including plywood, MDF, and particleboard—expected to rise by more than 15%.

More than $360 million of Russian birch entered the United States via Indonesia and Vietnam last year.

In 2024, the United States imported over $62 million of birch plywood from Russia,” according to a letter from the American Hardwoods Export Council (AHEC). “However, these direct imports from Russia pale compared to the nearly $200 million of birch plywood imported from Vietnam and the nearly $160 million imported from Indonesia.”

The investigation shows that Russian plywood is being smuggled en masse into numerous EU member states and that efforts by authorities to clamp down have been woefully inadequate. As a result, illegal blood-stained birch worth over 1.5 billion euros has been sold in Europe since sanctions took effect.

Piecing together information from insider leaks, trade documents and clandestine calls, we reveal the actorsThe investigation shows that Russian plywood is being smuggled en masse into numerous EU member states and that efforts by authorities to clamp down have been woefully inadequate. As a result, illegal blood-stained birch worth over 1.5 billion euros has been sold in Europe since sanctions took effect.

Piecing together information from insider leaks, trade documents and clandestine calls, we reveal the actors at every stage of the supply chain – from the manufacturing giants in Russia, through to the firms laundering their products in China, Kazakhstan and Turkey, and their customers in the EU.

at every stage of the supply chain – from the manufacturing giants in Russia, through to the firms laundering their products in China, Kazakhstan and Turkey, and their customers in the EU.

Russian non-commodity, non-energy exports to Vietnam could expand by supplying products from the wood-processing and aluminum industries as well as construction materials, and corresponding requests have been registered by the Russian Export Center (REC) from Vietnamese partners.

Memorandums have been signed on supplying meat products during the Russian delegation’s visit. There is demand for Russian aluminum products, construction materials, ash wood products in large volumes.

More than 90% of Russian lumber is traded to China; now, a new tariff—five times higher than those imposed on the EU—has made importing Chinese furniture parts non-competitive.

As it stands, China is responsible for taking more than 90% of all lumber produced by Russia (accounting for more than 63% of all lumber imported into China every year). Russia’s timber giants are now leaning on Chinese know-how to refurbish huge volumes of plant and equipment.

Billionaire Yevtushenkov’s Segezha Group continues to destroy huge volumes of ancient forests in Karelia as part of a growing trade with China and India.

The Segezha Group, controlled by the family of billionaire Vladimir Yevtushenkov, was, from the 1990s until mid-2022, subject to full FSC certification. This meant that the timber giant agreed to a moratorium to protect millions of hectares of ecologically rich Karelia forests near the Finnish border in exchange for selling timber into “ecologically sensitive” EU markets. “Between June and November 2022, Segezha Group opted out of the logging moratorium in ecologically valuable forests across Russia: from Karelia to Komi, Krasnoyarsk, Irkutsk, and Arkhangelsk,” Vox Europe said last year. “According to World Wildlife Fund, the total forested area Segezha withdrew from protection and is now allowed to log is 1.5 million hectares (3.7 million acres).”

A high-ranking official in the Russian military has been sentenced to 17 years in a high-security jail as part of a major fraud case involving the illegal harvest of timber from protected forests as well as inflated costs of timber materials used in the construction of trenches, bunkers and fortifications on the Ukrainian front line.

Results of the Australia’s Department of Agriculture, Fisheries and Forestry’s (DAFF’s) testing trial on timber species and harvest origins has clearly demonstrated the need for the Albanese Government’s tougher illegal logging laws with some alarming results from the study, Chief Executive Officer of the Australian Forest Products Association, Diana Hallam said today.

The recently completed DAFF trial tested 146 timber products and 39 distinct species using different scientific methods including DNA, stable isotope, trace element, wood fibre and wood anatomy analysis. A quarter of the tested products were found to be inconsistent with declared species, origin, or both. Product testing of laminated veneer lumber (LVL) product showed 80 per cent originating in China and 20 per cent from Russia, with the Russia component not declared.

Russia—until 2022, among the top 3 markets for global plywood production —is now flooding Asia, Latin America, and Africa with an oversupply of cheap wood in response to ‘crippling’ EU sanctions.

Mining is one of the fastest growing causes of deforestation, with a new report published by the World Resources Institue (WRI) revealing that 1.4 million hectares of forests, an area the size of Montenegro, was lost to the extraction of coal, iron and industrial minerals for the 20 years to 2020.Since the turn of the century, mining has increased by 52%. This includes tropical primary rainforests, some of the world’s most important ecosystems where mining is a growing loss driver, and Indigenous and local community territories, where people depend on forests for their livelihoods.

More than 89% of the loss is concentrated in just 11 countries, including Indonesia, Brazil, Russia, the United States, Canada, Peru, Ghana, Suriname, Myanmar, Australia and Guyana.

This article mentions a recent EUTR action whereby Belgian new genetic techniques to identify 260 tonnes of timber imported into Belgium from Russia illegally. Suspecting that Russian timber imports were continuing despite sanctions imposed after Russia’s invasion of Ukraine, researchers analysed samples against a sub-set reference library that related to the twelve nations thought the most likely candidates for the wood’s true origin, including samples taken from Russia. Having identified Russia as the region of origin, authorities were then able to trace the supply chain back through Latvia and Estonia, closing down an illegal import route and a lucrative Russian revenue stream.

Russia’s supply chain is bleeding, with Western sanctions to blame for one of Russia’s largest forestry and paper companies urgently raising funds through the Moscow Stock Exchange— causing its share price to plunge more than 20% in a single day’s trade.

Russia is suffering from high logistics costs, slowing Chinese demand, and increased competition from India, Brazil, and Argentina, forcing mills to cut production volumes.

According to China Customs, China’s imports of softwood logs have contracted 10% for the first six months of 2024 to 15 million cubic metres. In addition, the value of logs has also been in freefall, dropping 17% to $2 billion, from $141.45 per cubic metre to just $130 per cubic metre.

According to data from China Customs, Russia now accounts for 45% of all lumber imports – with Thailand, China’s second-largest importer, now responsible for more than 18% of lumber traded into the world’s largest forest economy.

China’s economic growth has slowed to 4.75%, compared to the rapid annual growth rate of 7% and 8% during the 2010s heyday.

Environmental crimes are destroying the Bolivian Amazon. In 2023, the loss of primary forests in Bolivia increased by 27 percent and reached its highest number on record for the third consecutive year: nearly 500,000 hectares, according to the Global Forest Watch platform.

The Plundered Amazon: The Roots of Environmental Crime in Bolivia, jointly published by InSight Crime and the Brazilian think tank Instituto Igarapé, highlights the transnational and cross-border dynamics of environmental crime in Bolivia, including wildlife trafficking, illegal mercury trafficking for gold mining, and timber trafficking.

Most of the deforestation in the Bolivian Amazon is due to gold mining and widespread land clearing for agribusiness .

The Latvian State Forest Service has fined a company € 10,000 for planning to import birch plywood from Turkey – with the State Forest Service alleging that the timber originates in Russia.

This article summarizes the science behind World Forest ID, but also gives a glimpse at the support provided by Australia, work now being done by IKEA (which used to source extensively from Russia and Belarus), and a recent Belgian investigation into illegally sourced wood imports.

Also reported here: Keeping Sanctioned Russian Timber Out of the EU Is Tricky. This Nonprofit Has a Solution. – WSJ

Dutch authorities have arrested two business owners, who are now accused of smuggling Russian timber into the EU via China.

The arrests were made by the FIOD—the Netherlands’s Fiscal Information and Investigation Service—responsible for investigating financial crimes and comes amid an EU-wide crackdown on conflict timber that continues to circumvent sanctions placed on Russia’s forest supply chain.

In a media release supplied by FIOD, the accused – a man (73) and woman (46) – will be tried under the Netherlands Sanctions Act and the Economic Offences Act – which could lead to a jail sentence.

Vladimir Putin has eased forex requirements on timber, energy, and agricultural exports – with Russia’s Central Bank pointing to a surge in export revenues and sky-high interest rates to help stabilise the rube.

Under the updated government decree, published on May 30, the bar has been lowered to 50% of all trade to be sold in Russian rubles.

It comes after the Russian government, in October, signed a decree to see “the mandatory sale of revenue in foreign currency received by Russian exporters under foreign trade agreements. The decree impacted Russia’s 40 largest exporters in forest products, grain, fuel, energy, black and non-ferrous metallurgy and chemicals.

Russian armed forces have targeted forests in and around the Kharkiv region to export timber and sell into Eurasian markets.

Ukraine’s biggest state enterprise, Forests of Ukraine, is scaling up lumber and raw log production to build new roads and enormous fortifications along Ukraine’s front line.

Russia and Belarus now account for 70% of all Chinese lumber imports.

Russia is ramping up plywood production, with exports to China surging more than 344%, according to new data provided by Roslesinforg – the Russian state-owned customs agency.

The latest numbers come after China Customs reported that exports to China had tripled for March. environmental groups have flagged concerns that China is operating as a broker for Russian and Belarussian timber, with plywood made from Russian birch entering European markets via China, Vietnam and a series of “friendly countries” across Eurasia.

In July 2022, the European Union responded to the war in Ukraine by banning the import of Russian woody biomass used to make energy. At roughly the same time, South Korea drastically upped its Russian woody biomass imports, becoming the sole official importer of Russian wood pellets for industrial energy use.

The EU has reportedly replaced its Russian supplies of woody biomass by importing wood pellets from the U.S. and Eastern Europe. But others say that trade data and paper trails indicate a violation of the EU ban, with laundered Russian wood pellets possibly flowing through Turkey, Kazakhstan and Kyrgyzstan to multiple EU nations.

EU pellet imports from Turkey grew from 2,200 tons monthly last spring to 16,000 tons in September. Imports from Kazakhstan and Kyrgyzstan reportedly rose too, even though neither has a forest industry. A large body of scientific evidence shows that woody biomass adds significantly to climate change and biodiversity loss.

Enviva, the world’s largest woody biomass producer, which operates chiefly in the Southeast U.S., may be the big winner in the Russian biomass ban. Since the war began, Enviva has upped EU shipments, and also announced a 10-year contract with an unnamed European customer to deliver 800,000 metric tons of pellets annually by 2027.

Wood Central reports that, for April 2024, South Korean imports of Russian wood pallets jumped 27%, with more than 200,000 cubic tonnes traded from Moscow to Soel from January to April alone. 85% of Russia’s Logs Are Sent to China—Where Do They End Up? | Wood Central

Until early 2022, Australian timber importers relied on Russia for 40% to 50% of all LVL, formwork and beams entering the Australian building and construction supply chains.

However, that changed in mid-2022 when the European Union banned Russian and Belarusian timber exports, whilst PEFC and FSC suspended certification schemes in both countries. And whilst Australia opted to slap a 35% tariff on Russian timber rather than following the lead of the EU and the UK in introducing a total ban, FSC and PEFC deemed that all products coming from Russia and Belarus (irrespective of secondary ports) are conflict timber, and therefore, cannot be used in PEFC and FSC claims.

According to the Australia’s EWPAA, “signs of non-conforming LVL include missing branding details, questionable certification, and a lack of acceptable documentation.”

Until early 2022, timber importers relied on Russia for 40% to 50% of all LVL, formwork and beams entering the Australian building and construction supply chains. However, that changed in mid-2022 when the European Union banned Russian and Belarusian timber exports, whilst PEFC and FSC suspended certification schemes in both countries. And whilst Australia opted to slap a 35% tariff on Russian timber rather than following the lead of the EU and the UK in introducing a total ban, FSC and PEFC deemed that all products coming from Russia and Belarus (irrespective of secondary ports) are conflict timber, and therefore, cannot be used in PEFC and FSC claims. In 2022, the publisher of Wood Central exclusively revealed that record shipments of Russian LVL were entering Australian ports via China following Putin’s invasion of Ukraine.

Lumber exports from the EU’s largest timber economies are in decline, thanks to a shortage in biomass in the Baltic states. However, with the roll out of the Green New Deal there are concerns that European countries will not be able to balance increased harvesting with climate commitments.

An investigation by the European Commission has confirmed the circumvention of anti-dumping duties by firms buying plywood from Turkey and Kazakhstan. The investigation found evidence of laundering of finished Russian plywood – a breach of EU sanctions put in place following the Ukraine invasion.

Inspectors also confirmed Turkish and Kazakh firms are using Russian raw materials to make birch ply for sale in Europe. The European Commission investigation found evidence of plywood made in Russia being simply laundered and re-labelled as of Kazakh or Turkish origin, something which should be of interest to authorities tasked with enforcing EU sanctions, both at EU and Member State level. Though not covered by sanctions, these sales are in clear breach of the EU Timber Regulation (EUTR), a law meant to halt illegal wood use in Europe.

Today Earthsight, which submitted evidence to the EU’s investigation, has filed EUTR complaints pertaining to 31 firms across nine member states whose suppliers were confirmed by the EU to be using Russian raw materials.

Almost 30% of Ukraine’s total forest area has been destroyed by conflict, with Russian armed forces logging Ukrainian forests and selling timber into global markets via “friendly countries.”

Russia is now facing a growing gap between timber production and log supply, with production growing 5% in 2024, while commercial logging of Russian forests has nose-dived 26%.

That is according to Lesprom’s “Russian Lumber Industry Insights,” which reports that Russian sawmills are now bleeding thanks to a critical shortage in raw materials and are struggling to meet rising demand from major export markets.

The problem for Russia is that Western Companies—which provided much of the foreign direct investment needed to modernise logging operations in the decades leading up to the 2022 war—have now exited the country on mass, creating large gaps in the Russian supply chain.

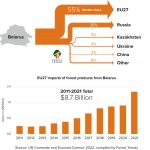

Poland is the new gateway for Belarussian timber, with the import of timbers (via Kazakhstan) surging. A joint investigation involving the Belarussian Investigative Center, Radio Free Europe, and Polish newspaper Gazeta Wyborcza alleges that Polish imports of timber from the largely deforested Kazakhastan grew from €14 million (pre-war) to more than €68 million last year as part of a €126 million global trade in conflict timber.

Also featured in Belarus evading EU sanctions by importing timber to Poland with false documents, finds investigation | Notes From Poland and Fraud Exposed: Poland Now EU’s Ground Zero for Conflict Timber | Wood Central

Sanctioned Russian birch plywood worth an estimated €40 million has been seized at Rostock Port in Germany. The ship was en route to the United States, but stopped in Germany for an emergency. The Canadian-owned shipping firm argue that the vessel’s cargo should be exempt, because it only docked in Germany due to an emergency. German Customs have rejected that argument. The wood may be linked to a Russian timber giant Sveza, which is part-owned by Alexei Mordashov, Russia’s richest man and a subject of EU and US sanctions.

Also reported here:

€40M of Conflict Timber Seized: How the US $2B Log Trade Fuels War | Wood Central

There is an import ban on Russian timber. In fact, EU sanctions are being circumvented on a large scale. Chinese companies play a key role, as frontal reveals.

Scientists are using state-of-the-art tech to correctly trace the flow of timbers entering the EU from Russia and Belarus and have developed a new framework that policymakers can use to eliminate conflict timber worldwide.

Developing the world’s largest reference database for Eastern European timber species (Betula, Fagus, Pinus, Quercus) tailored to sanctioned products; scientists can correctly predict, with 82% accuracy, “false claims” coming from Russia as well as harvest locations “within 180 to 230 km of the actual location.”

The European Commission has disclosed the findings of its anti-circumvention investigation into illegal imports of Russian birch plywood. The findings disclosed to relevant stakeholders show evidence that Russian birch plywood is being imported into the EU market through Kazakhstan and Türkiye to avoid paying anti-dumping duties. As Russian wood products are also subject to sanctions in the EU, the results of this investigation are expected to lead to further action by national authorities and the European Anti-Fraud Office (OLAF).

A cross-border probe, led by ICIJ and first published in March 2023, involved 44 media partners globally and documented how Western environmental auditing firms and governments failed to stop the trade of wood logged in conflict zones.

The findings supported a June investigation from ICIJ partners Paper Trail Media, Der Spiegel, ZDF and others that similarly revealed how Russian timber continued to circumvent the EU’s embargo, making its way into the bloc by routing through countries like China, Turkey, Kazakhstan and Kyrgyzstan.

When Russia invaded Ukraine in February 2022, sanctions swiftly followed, including a total ban on Russian timber imports into the European Union (EU) from July 2022. Belgium, one of the staunched supports of the EU ban, has become a profitable destination for Russian wood. Using a forensic laboratory at the Royal Museum for Central Africa in Tervuren, inspectors determined that several wood shipments from Russia had arrived in Belgium. The number of fines imposed for illegal harvests almost tripled in 2023.

“But an impediment is a distinct lack of inspectors,” Wynant said. “There are now fewer than five timber inspectors working full-time in Belgium, but there are 4500 timber importers,”according to the article .

The Ukrainian Embassy Malaysia reported on the ecological damage to Ukrainian forests. One-third of the countries forests are damaged, and illegal logging is rampant in national parks and reserves in areas occupied by Russian forces.

The United States and Australia have some of the softest compliance actions against Russian wood in the Western World, with the Biden administration opting not to follow the UK, EU and more than 130 global ENGOs in introducing a sanction on all timber imports after the Ukrainian Parliament asked all “friendly countries to sanction Russian timber.

It includes FSC and PEFC – the world’s largest private forest certification labels – which cancelled Russian and Belarussian certificates.

Since March 2022, more than US $1.98 billion worth of timber has been imported from Russia.

Timber trade from Belarus has increased six times since the start of the Ukraine conflict amid fears that Azerbaijan is being used to bypass sanctions. Since early 2022, western sanctions on Russian and Belarussian trade have limited the export of pulp, paper and softwood to nine countries – China, Kazakhstan, Belarus, Uzbekistan, Iran, Kyrgyzstan and the United Arab Emirates and Azerbaijan

Russia and Belarus are ramping up timber exports to Uzbekistan amid fears the former soviet state could act as a new trading post for conflict timber entering global timber supply chains.

It comes as Uzbekistan is spending billions on new rail, road and sea infrastructure, funded by China’s Belt and Road Initiative, forging new pathways for timber to infiltrate global supply chains.

Already, Uzbekistan is Russia’s second-largest importer of softwoods, with 480,000 cubic metres of timber (or 11% of its total imports) imported into the country every quarter – in what is a significant escalation in trade since the start of the Russian invasion of Ukraine.

It comes as Wood Central reported in July that a block of ten countries – including Uzbekistan as well as China, Kazakhstan, Belarus, Iran, Kyrgyzstan, the United Arab Emirates, Azerbaijan, and Tajikistan – is fueling a booming trade of conflict timber bypassing western sanctions.

Vanuatu forest authorities last week banned Vanuatu Forest Industry Ltd (VFIL) from exporting logs while they investigate landowners’ complaints that trees were cleared without permission on the island of Santo. The export of round logs is banned in Vanuatu, although a government inquiry in 2021 found endangered rosewood being illegally exported to China, where it is prized for furniture.

While this article is mainly about the closure of a sawmill in New Zealand, it notes the large amounts of engineered wood products from China into New Zealand, the rapid expansion of laminated veneer lumber (LVL) plants in China, and the likelihoods that the Chinese imports “likely also include logs from Russia processed into LVL in a ‘back-door diplomacy’ arrangement by the two countries.”

While this article is mainly about the closure of a sawmill in New Zealand, it notes the large amounts of engineered wood products from China into New Zealand, the rapid expansion of laminated veneer lumber (LVL) plants in China, and the likelihoods that the Chinese imports “likely also include logs from Russia processed into LVL in a ‘back-door diplomacy’ arrangement by the two countries.”

Since Russia invaded Ukraine, the country’s relationship with China took on even greater significance. More than 83% of Russia’s timber export goes through Chinese supply chains, with China now Russia’s distribution point to global forest markets.

Chinese shipping companies like the Shandong Port Group play a crucial role in Russia realising its Arctic transport aspirations. The company includes four major seaports in the Chinese Shandong region and are looking for more.

Komi Governor Vladimir Uiba – who has strong ties to the failed Wagner group – is pushing to attract Chinese investment in forest processing. Komi is Russia’s second-largest state and is home to the Virgin Komi Forests – a UNESCO World Heritage Site and the largest virgin forest in Europe.

The European Commission is investigating potential illegal imports of Russian birch plywood products into the European Union. CELEX:32023R1649:EN:TXT.pdf (europa.eu) There has been a significant increase in imports of Russian birch plywood into Turkey and possibly Kazakhstan, and an increase in exports of birch plywood from both countries to the EU—although neither has been a significant producer of birch plywood in the past. The EU banned Russian wood after Russia invaded Ukraine.

ICIJ partners in Europe revealed the indirect trade routes used to mask the origins of Russian timber, which continues to flow into the EU despite being banned.

Paper Trail Media, Der Spiegel, ZDF and others analyzed trade data to trace the pathway of banned wood through third countries, including China, Turkey, Kazakhstan and Kyrgyzstan.

Russian mercenaries with close ties to President Vladimir Putin and a logging contractor exposed for funding African rebels help feed a barely-regulated European timber rush in one of the world’s poorest and most fragile countries, according to a new report by Earthsight.

New evidence shows that an obscure company reportedly controlled by the Russian Wagner paramilitary group supplied timber to European consumers. The trade embroils a firm listed on London’s AIM stock exchange that was part of a national delegation at the COP26 UN climate summit in Glasgow.

Before Russia’s invasion of Ukraine in February 2022, about 80% of all birch plywood globally was produced in Russia, Belarus and Ukraine.

After the fifth package of sanctions imposed on Russia by the EU finally entered into force in July 2022, the import of roundwood and wood products, including birch plywood, from Russia to the EU was banned. However, according to information and statistics obtained from the market, it seems that illegal Russian birch plywood continues to be imported to Europe from third countries.

This is reflected in increased imports of birch plywood from countries such as Kazakhstan and Turkey. Considering the production capacity of Kazakhstan, we can see that the country does not have sufficient birch plywood production to be able to deliver the volumes recorded in the statistics.

Illegal birch plywood travels to the European markets in many ways. The import ban is evaded by transit through a third country, for example. The third countries may also make minor changes to the plywood, after which the country where the changes were made is reported as the products’ country of origin. Another way is to use a false tariff heading so that the product is excluded from sanctions.

Russia has been accused of engaging in industrial-scale logging in Ukraine, cutting down large swaths of trees for sale and to strengthen its defensive positions. In a letter to President Putin, Russian Defense Minister Shoigu requested permission to harvest timber and stated that “wood not used for defense will be sold to finance the military operation.”

The EU first imposed trade sanctions on Belarus timber products on 2 March 2022. These were extended to Russian timber products on 8 April 2022. On 10 March 2022, Russia’s Industry and Trade Ministry announced a ban on all wood and timber-related exports to “unfriendly countries”, including the EU, UK and US. Both leading certification organisations, the PEFC and FSC, announced in March 2022 that all timber originating from Russia and Belarus would be categorised as ‘conflict timber’ (i.e. from a controversial source) and not eligible to be sold and promoted as PEFC- or FSC-certified. This had a significant impact on many European companies which had become heavily dependent on Russia and Belarus for their supplies of certified wood.

The EU first imposed trade sanctions on Belarus timber products on 2 March 2022. These were extended to Russian timber products on 8 April 2022. On 10 March 2022, Russia’s Industry and Trade Ministry announced a ban on all wood and timber-related exports to “unfriendly countries”, including the EU, UK and US. Both leading certification organisations, the PEFC and FSC, announced in March 2022 that all timber originating from Russia and Belarus would be categorised as ‘conflict timber’ (i.e. from a controversial source) and not eligible to be sold and promoted as PEFC- or FSC-certified. This had a significant impact on many European companies which had become heavily dependent on Russia and Belarus for their supplies of certified wood.

EU27 import value of wood and wood furniture from China increased only 4% to US$6.0 billion in 2022, although this did build on a massive 42% gain the previous year. Import value from Ukraine also increased by 9% to US$1.9 billion in 2022, despite the serious disruption due to the war, following a 55% gain the previous year. Other significant beneficiaries were Turkey, for which EU27 import value increased 32% to US$890 million last year, and non-tropical products from Brazil which recorded a 54% increase to US$ 690 million in 2022

On the anniversary of Russia’s invasion of Ukraine last week, G7 countries announced new sanctions on Russia and Belarus.

This new Earthsight article shows that since the conflict began, the USA, Canada, Japan, the EU and the UK have imported timber and wood products worth over $2.9 billion from Russia and Belarus.

Though the EU and UK have sanctions in place on most wood products, they omit some key products. Meanwhile Japan, the US and Canada have not put into place any ban on wood products from Russia and Belarus.

Earthsight’s latest report revealed that over $1.2 billion of Russian plywood has been sold in the US since the conflict began, with profits funneling directly to Putin’s allies, and possibly helping to fund Russia’s military.

*******************

The article is a useful summary of the existing sanctions put into place on Russian and Belarus timber products.

Not long after imposing sanctions on wood imports from Russia and Belarus, Europe saw an influx of wood supposedly coming from Kazakhstan and Kyrgyzstan. Authorities say sanctions-busters are increasingly mislabeling wood as Central Asian so they can keep bringing it in to the EU.

Key findings:

Traders are evading European Union sanctions on Russian and Belarussian wood by declaring that it really comes from Central Asia.

Customs in Lithuania and Latvia are scrambling to keep up with the sudden influx of timber with suspect paperwork from Kazakhstan or Kyrgyzstan.

Reporters found several Kyrgyz and Belarusian companies that offered false paperwork so traders could ship banned Belarusian wood to the EU.

HO CHI MINH CITY, Vietnam — Russian birch wood has continued to flow to American consumers, disguised as Asian products, despite U.S. economic sanctions imposed on Russia over its invasion of Ukraine, a new report says.

A recent report by European Investigative Collaborations (EIC), a transnational investigative journalism project, claims that the Wagner Group, a Russian paramilitary group with close links to the regime of Vladimir Putin and active in the Ukraine war, is engaged in the forestry business in the Central African Republic (CAR).

The report Bois Rouge was conducted in collaboration with All Eyes on Wagner, an open-source investigative project by French NGO OpenFacto that tracks Wagner’s global influence.

Wagner, which is reputed to be run by Yevgeny Prigozhin, a Russian oligarch and close confidante of Russian President Vladimir Putin, has long been reported to offer private security services to African partners – among them the CAR, Mali, and Sudan – in return for exclusive rights to gold and diamond mining in strategic areas.

However, All Eyes on Wagner says that Wagner’s interests also extend to the forestry trade in the CAR.

Timber Trade Federation (TTF) issued import warning for TTF-members on birch plywood from the Far East.

“It has been nearly six months since Russia’s awful invasion of Ukraine, with few signs the conflict is going to abate anytime soon.

Though grain exports began to leave Ukraine this week for the first time since the war began, international sanctions on Russia remain very much in place.

Along with maritime sanctions and restrictions on Russian payments, the most significant sanction for our industry is the Russian timber import ban.

An investigation reveals evidence linking the Wagner group, a group of Russian mercenaries, with a timber concession in the Central African Republic

Timber chiefs have warned that imports of the material from Russia or Belarus could now be deemed illegal in the UK. The Timber Trade Federation (TTF) told its members that purchases from suppliers in the ostracised nations could fall foul of regulations initially coming into force nine years ago in part to tackle illegal logging abroad.

FSC and PEFC have barred wood and timber from Russia and Belarus from their certified products, as a host of other industry suppliers go public with their stance against Russia’s war in Ukraine.

Deforestation accounts for at least 15% of all greenhouse gas emissions.

Illegal deforestation, done too quickly for forests to regrow naturally, still takes place in Europe, especially in Eastern European countries. Products manufactured from illegally logged wood have made their way on the market in the UK.

Ikea is likely to have sold children’s furniture for years made from wood linked to illegal logging in Russia, where rampant tree-cutting threatens forests crucial for the planet’s climate, according to a new report by a nonprofit environmental group.

Sanctions breakdown as Belarussian timber exports surge 8-fold for the first three months of 2024.

Timber exports from the heavily sanctioned Putin-aligned state have exploded over the past 12 months, with more than 365,000 cubic metres of sawn wood traded into 15 “friendly nations” in the first three months of 2024 alone.

That is according to the government-backed Belarusian Universal Commodity Exchange (BUCE), which reported that Belarus timber production was up eight times over the January to March quarter for 2023, with the total output of Belarussian timber reaching 748,000 cubic metres— including 49% traded into global markets via third-party Eurasian trading ports.

Click here to access the Global Illegal Logging and Associated Trade (ILAT) Risk assessment tool and to download the Forest Trends User Guide describing the functionality of the ILAT Risk Data Tool.

Click here to access the Cattle Data Tool.