Financing Low Emissions Rural Development:

Bridging Financing Gaps & Jurisdictional REDD+ Bonds

By Rupert Edwards, David Tepper, Sarah LoweryBridging Financing Gaps

Bridging Financing Gaps for Low-Emissions Rural Development through Integrated Finance Strategies

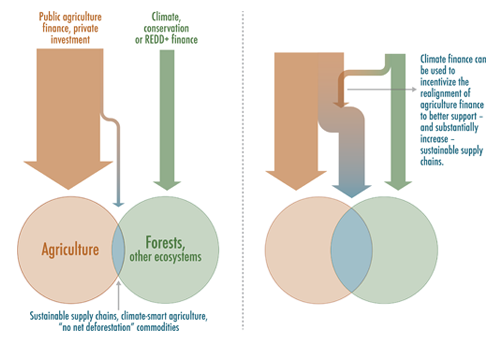

REDD+ funds are limited, but agricultural finance pools are quite large. Integrating these pools of finance can help catalyze substantial additional finance flowing into sustainable agriculture that conserves forests.

The amount of capital deployed through REDD+ is just a small percentage of what is needed. Reducing Emissions from Deforestation and forest Degradation by 50 percent will require between $17 and $33 billion per year, but only $4.5 billion was deployed for REDD+ was through 2012. In contrast, financial flows to the agriculture sector are quite large: average annual investment by domestic private sector actors (i.e., farmers) into just a portion of low- and middle-income countries is $168 billion; and government expenditures on agriculture in a subsection of these countries is $160 billion.

Now is also a critical time in which supply chains are aiming to decrease their deforestation and become more sustainable overall, but many barriers to producing sustainably include higher costs of production, traditional financing barriers in the agricultural sector and the opportunity costs of leaving forests standing. The financial flows to the agriculture sector represent substantial pools of capital that can potentially be unlocked to support sustainable supply chains.

In a new report – Bridging Financing Gaps for Low Emissions Rural Development through Integrated Finance Strategies – we explore ways that agricultural finance can be realigned and integrated with REDD or climate finance to overcome these barriers and further incentivize and reward sustainable production.

Bridging Financing Gaps for Low-Emissions Rural Development through Integrated Finance Strategies

Cerrando las Brechas de Financiemiento del Desarrollo de Bajas Emisiones Rurales a Través de Estrategias Integradas de Financiemiento

Jurisdictional REDD+ Bonds

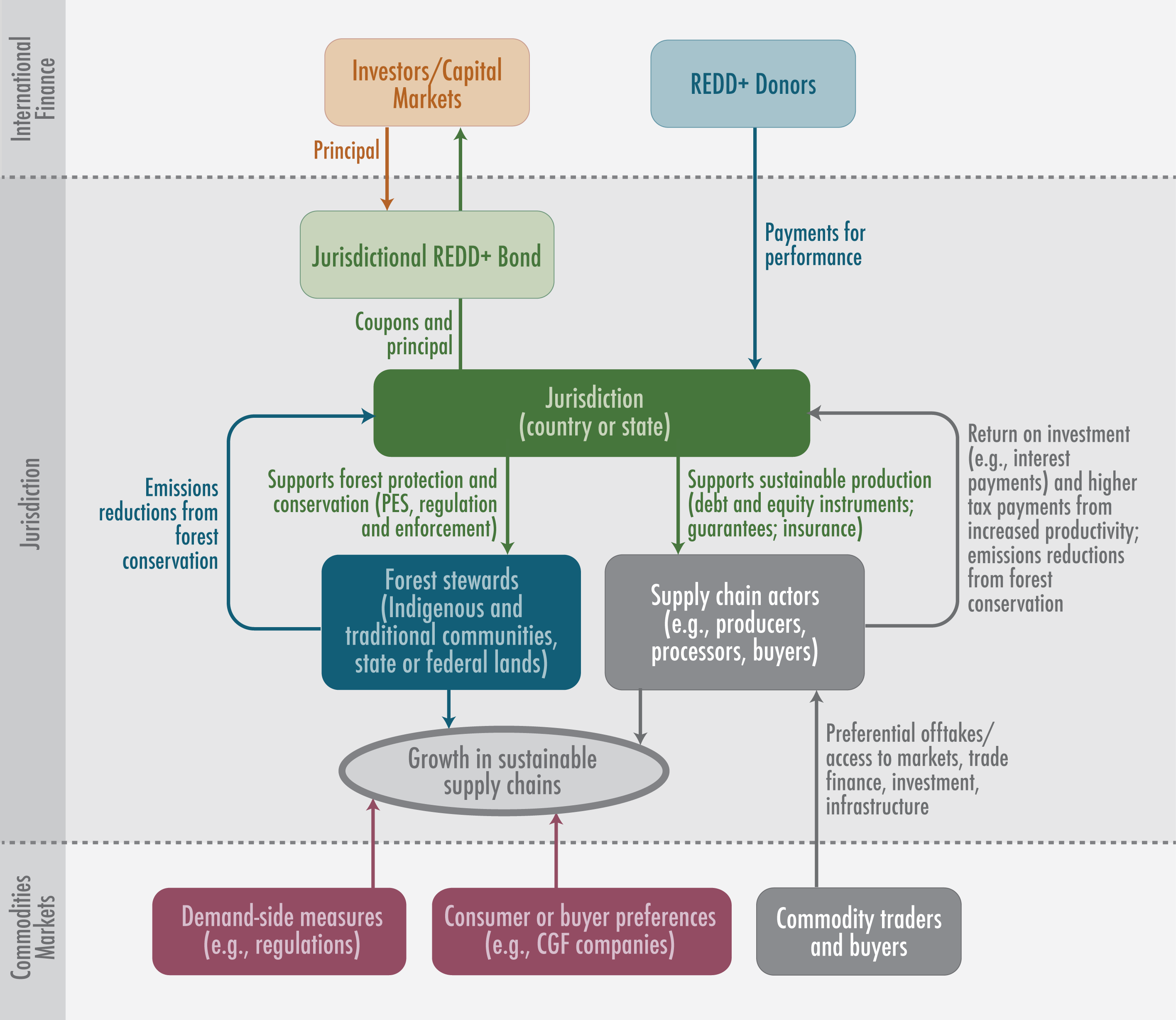

Jurisdictional REDD+ Bonds: Leveraging Private Finance for Forest Protection, Development, and Sustainable Agriculture Supply Chains

REDD+ finance is designed to conserve and enhance forests across the developing world, but it needs a jump-start of its own – especially at the national and sub-national levels. Jurisdictional REDD+ Bonds could be part of the solution.

Many jurisdictions (municipalities, departments, states, countries) have reduced their rates of deforestation and are making progress on REDD+ programs that monitor, report, and verify their emissions reductions, establish the institutional infrastructure necessary to support REDD+, and protect indigenous and other traditional communities’ rights to ecosystem services including carbon.

Investment is needed in both forest conservation and improved agriculture productivity that can supply markets with zero net deforestation commodities even as global demand for food, fuel and fiber rises That will require capital NOW in order to meet longer-term REDD+ goals.

Jurisdictional REDD+ Bonds: Leveraging Private Finance for Forest Protection, Development, and Sustainable Agriculture Supply Chains discusses a possible solution to this problem. This brief outlines a financing structure that has the potential to help integrate REDD+, the efforts of governments, farmers, indigenous communities, NGOs and commodity buyers and source additional upfront investment from mainstream capital markets.—by linking bond cash-flows to public Results-Based Financing programs from governments in advanced economies or via the UN Green Climate Fund.